-

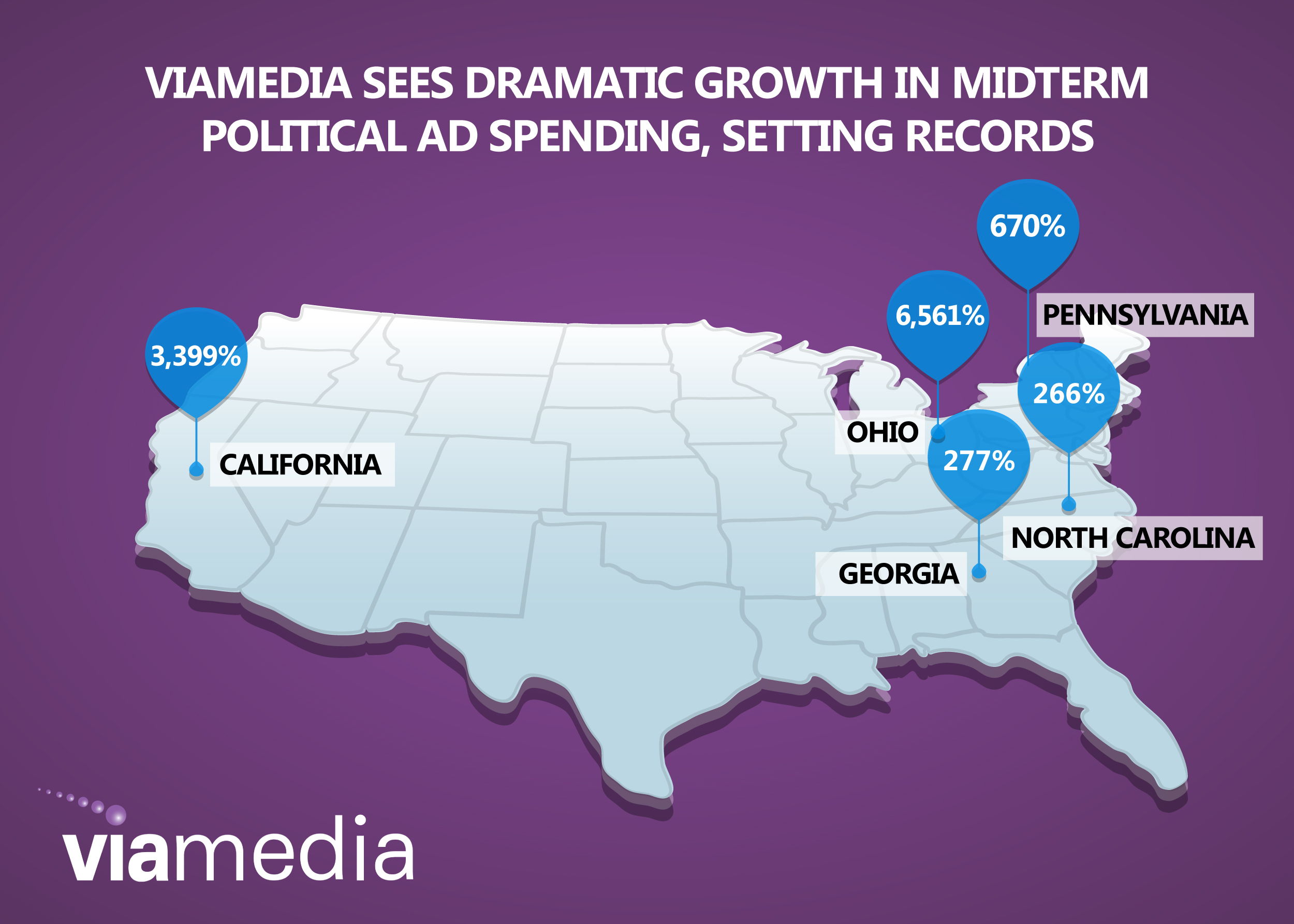

Country’s Leading Independent Provider of Ad-Sales Representation to Cable TV Systems Sees Triple-Digit – and Higher – Growth in “Battleground” States

New York City – April 26, 2022 – Viamedia, the leading fully-integrated independent cross-media local advertising company, today announced record first quarter Midterm political advertising, representing an increase of 42% vs. first quarter 2018, across all political categories -- including House, Senate, gubernatorial, local races and issues -- throughout its footprint across the country.

The company saw particularly robust activity in hotly contested states.

- In North Carolina, Viamedia saw 266% growth for first-quarter 2022 vs. first-quarter 2018, driven by conservative political action committee (PAC) spending, including for the open U.S. Senate race there;

- In Georgia, Viamedia saw 277% growth, driven by spending in the gubernatorial and U.S. Senate races;

- In Pennsylvania, home to a gubernatorial contest and a particularly high-profile Senate race, both open-seat races, Viamedia saw 670% spending growth;

- In California, Viamedia saw an explosion of issues spending around climate change and gambling, driving up the spending the company handles there 3,399%;

- And in Ohio the company has seen spending vault by 6,561% across various races, including another high-profile, open-seat Senate contest.

The company also saw a significant spike in digital political advertising, driving the portion of spending on digital to 18% of the total in first-quarter 2022 vs. 4% in first-quarter 2018 – though the digital spending remains dwarfed by linear TV spending.

The data was culled from political advertising purchased on more than 60 multichannel video programming distributors (MVPDs) of various sizes in more than 70 markets.

“What we’re seeing, so far this season, underscores the reliability of political advertising directed primarily at linear television platforms,” said David Solomon, President & CEO at Viamedia. “We have robust insights into the local ad trends around the country.”

He added, “Campaigns and PACs understand the power of the big-screen format – whether linear TV, CTV or OTT -- for getting their messages across to constituents. All video providers are now managing record order inflows. Nothing beats local for candidates seeking to get their message out and for our clients to super serve this cycle’s political advertising.”

About Viamedia

Viamedia places over 1MM ads a day in more than 130 zones in 28 states across 60+ markets nationwide, aggregating all forms of TV audiences and providing a single point of sale to more than 6,000 local, regional, and national advertisers. It provides a comprehensive portfolio of audience and impression-based local video cross-media advertising solutions that bridge the gap between linear TV and digital programmatic advertising.

Viamedia’s patented, cloud based QTT® platform utilizes a proprietary technology stack and is designed to enable ad campaigns to be more efficient and easier to execute, by utilizing rich data to deliver targeted, dynamic ads to consumers via linear television.

Viamedia also offers a complimentary suite of impression-based digital products for streaming, mobile, display, email, search, social and more. Headquartered in Lexington, Kentucky, the company’s success is built on its people, processes and proprietary software.

For more information, please visit https://viamediatv.com.

For more information, contact:

Andrew Laszacs

Bob Gold & Associates

310-320-2010

VIAMEDIA SEES DRAMATIC GROWTH IN MIDTERM POLITICAL AD SPENDING, SETTING RECORDS

Ad-Tech Innovator QTT® Launches Marketplace to Drive Seamless Digital, Linear TV and Interoperability

-

Launch Follows Receipt of Patents Achieving Advertising-System Interoperability Among Broadcasters, Cable Networks, MVPDs and

Digital Supply and Demand Side Platforms

Initial Television Participants Include A+E Networks, FOX, Reelz

Magnite Is First Participating SSP

New York City and Lexington, KY – August 24, 2021 – Buyers and sellers of linear television ad inventory now have a fully transparent solution enabling them to automate and expedite the activation of data-driven linear video inventory without changing existing workflows or technologies.

QTT®, a video platform that bridges existing standard digital and TV advertising technologies andmakes linear TV advertising behave digitally, today announced the launch of QTT® Marketplace. QTT Marketplace is an open-platform destination for advertisers and agencies accustomed to digital platforms to access directly a wealth of premium, curated local and national television inventory – and for television inventory owners to tap more directly into the rapidly growing digital ad pool.

“The last mile to activate linear TV advertising through existing digital platforms is finally here,” said John Piccone, president of QTT. “Buyers and sellers can now take advantage of their investments in data-driven audience planning tools by activating at scale through QTT’s seamless translation platform. As a result, we now have an array of partners offering premium television inventory through demand- and sell-side platforms to connect them directly with traditional and new digital advertisers.”

The QTT Marketplace launch follows the completion of a family of QTT patents delivering seminal steps in the integration of the pan-device digital and linear television advertising ecosystems.

The QTT Marketplace is a new extension of QTT software developed to allow agencies and media buyers to see the linear ad packages – including rates, scheduling and number of spots -- made available by QTT licensees including MVPDs, broadcast television stations and broadcast and cable networks. An ad campaign can then proceed seamlessly via any respective demand-side platform (DSP) and SSP through the VAST standards and Deal IDs to complete a brand-safe transaction that delivers the campaign’s message to premium audiences.

“A+E Networks has been on the forefront in building scalable demand-side partnerships,” said Ethan Heftman, SVP Advanced Advertising and Digital Sales at A+E Networks. “QTT and its Marketplace are a one-two punch that automates access to new demand while ensuring control over our pricing and inventory.”

“At FOX, we continue to find ways to better serve our clients and look for solutions to drive incremental yield while reducing the workflow efforts to leverage our advanced TV technologies,” said Dan Callahan, SVP Data Strategy and Sales Innovation for Fox. “Earlier this year, we partnered with Operative to move all linear sales to a single cloud system and, in turn, this allowed a seamless partnership with QTT to connect specific cable network linear avails to digital ad platforms.”

“More and more digital advertisers are looking to linear TV to increase their reach efficiently,” said Bill Rosolie, SVP Advertising Sales at ReelzChannel. “We see QTT as a platform to unlock the value of target-rich audiences across our portfolio of independent networks.”

"In our environment where most ‘game-changing technology’ really isn't, the QTT Marketplace is," said Eric Fischer, Founder and CEO of buying agency HJA Strategic Marketing. "Their ability to provide a solution for digital-first advertisers to seamlessly access unduplicated linear TV audiences at scale, and conversely provide linear TV networks access to thousands of digital advertisers, adds a whole new dimension to the TV buying ecosystem."

Leveraging the existing Video Advertising Standard Template (VAST) tag, the patented QTTapproach allows digital platforms to develop their own solutions to bring linear television inventory to complement their digital buys. As the first sell-side advertising platform (SSP) integrated with QTT, Magnite, the world's largest independent SSP, developed its own proprietary solution that complements QTT’s patented technology and exposes linear inventory programmatically to buyers based on existing TV measurement currencies. Because digital attributes such as Video Ad Serving Template (VAST)-based impression pixels aren't available on linear platforms, Magnite’s methodology captures, and reports ratings based upon viewing windows agreed to by media owners and marketers.

“Our clients have been asking for streamlined tools to enable programmatic monetization of their linear inventory and complement their CTV advertising efforts,“ said Todd Randak, SVP Strategy and Partnerships at Magnite. “With QTT we can now offer premium linear TV opportunities through the Magnite platform as if they were any other digital video ad.”

“The conversion of linear-enabled avails to VAST tag-enabled avails, is a pivotal development,” Piccone noted. “And, importantly, the QTT Marketplace keeps the control in the hands of the respective parties in a transaction. Advertisers get full transparency and accountability for their buys. Broadcasters, cable programmers and MVPDs maintain complete control over their inventory and pricing.”

About QTT®

QTT®, based in New York City, is a first-of-its-kind cloud-based television advertising solution that requests and receives ads from programmatic digital ad exchanges to enable linear cable television ad insertion utilizing existing cable and broadcast TV infrastructure. QTT is integrated with leading SSPs and DSPs and converts a single DSP/SSP digital ad call into a linear TV ad placement, facilitating private marketplace deals with the local broadcasters and broadcast and cable networks who have licensed the solution. QTT® is a division of Viamedia, the Lexington, Kentucky, based provider of comprehensive audience and impression-based local video cross-media advertising solutions. Its platform has exclusive cable TV ad inventory from more than 60 MVPDs in 31 states across 69 DMAs, offering advertising on cable TV networks to more than 6,000 local, regional and national advertisers. QTT is and can be deployed well beyond Viamedia’s footprint. For more information about QTT, please visit https://viamediatv.com/qtt. For more information about Viamedia, please visit https://viamediatv.com.

For more information, contact:

Tom Campo or Bob Gold

Bob Gold & Associates

310-320-2010

BEYOND THE BASICS: Put Your Marketing in Motion with Video Advertising

What Digital Buyers Need to Know About Linear TV

-

By John Piccone, President QTT®, a division of Viamedia

Published on Independent Communications News April 28, 2021

There is a whole new generation of advertising buyers and sellers who have fallen in love with the features of advertising technology without understanding the marketing objectives that drive media decisions.

To the digital buyer, critical metrics of success live in the headers of their analytics reports which represent bottom funnel metrics. Absent are traditional building block metrics that live in media mix modeling that have guided marketer’s media decisions for decades.

Nowhere is this more apparent than video advertising. Today a marketer can place its video advertising in many places: Linear TV, Connected TV, Desktop, Mobile and Digital Out of Home. But for decades, the lion’s share of video advertising share has gone to linear TV. Why is that? Simple…

TV Advertising Works

And advertisers know TV works. They may not have real time dynamic ad serving reporting, but decades of trial and error have shown TV works and as time passes the linear TV attribution game is only getting better. Correlations based on ad occurrence and website or mobile traffic generates millions of data points to give marketers even better insights on the value of TV.

Measurement Favors the TV Advertiser

A viewer must watch an average of 5 minutes of the TV program to be counted, even though many more people sample a TV show. Compare that to an online video ad that needs to be visible for only 2 seconds.

TV’s pricing can’t be beat.

Marketers have relied on Nielsen’s household sample to measure television viewership for decades. Most linear buys are against a broad demo group (Adults 25-54, Women 18+, etc) These Nielsen demos are priced by the sellers based on demand, supply and historical rate cards. This is no different if a digital buyer wants to buy a broad demo on YouTube or CTV. However, the key difference is that on TV you pay only for those audiences in that purchased demo. So due to the “spill” nature of TV the advertiser also gets everyone else who watch its ads, for free. Whereas with online video, thanks to dynamic ad serving only the purchased target audience sees the ad. If we run the advertising math, a TV Demo CPM of $20 on TV is actually a tiny fraction of that when you factor all the people who saw the ad. And for marketers who are building a brand, every eyeball counts. On the other hand, digital video CPMs remains static, or actually increase in the case of fraud or bot traffic.

Are there many benefits that digital video advertising offers that TV cannot? Of course. But it’s still clear that the cost of media, coupled with the advertiser-friendly measurement standards, is very hard to beat TV.

Inevitably the linear and digital worlds will collide. Marketers can now buy TV programmatically when it meets both buyer and seller objectives. Spoils will go to those who can understand linear and digital measurement and pricing metrics. Visit https://viamediatv.com.